Investment Topics #1: Why Invest?

People often come to me with concerns about investing in the financial markets, such as, “How can I invest and not be stressed out?” “How can I trust that I won’t be ripped off?” “All these investment jargons make everything so confusing,” and “I don’t want to risk losing everything.” Maybe you grapple with the same investment questions. So why do people invest? Is it really a good idea? In the next few articles, I want to help you understand how to invest your hard-earned money with confidence and have it work for you, even when the investment road gets bumpy (because it will).

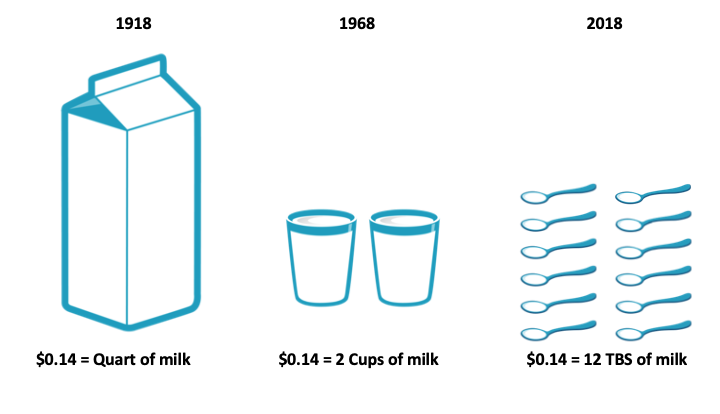

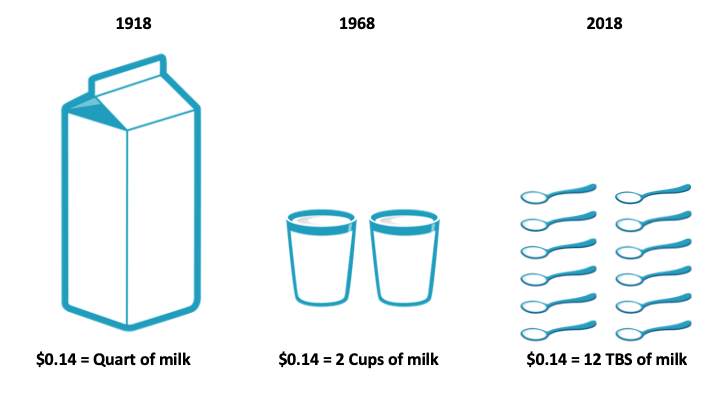

Along with managing your cash-flow and budgeting for your spending, you will also need to be investing for the rest of your life. Why? Because your money today will likely buy you less tomorrow. For example, let’s look at the price of milk from 1918 to 2018. In 1918, a quart of milk would cost you 14 cents. Today, 14 cents will get you enough milk for a couple of lattes (12 tablespoons to be exact). It is important to get your money to work for you with the maximum value that it holds today.

Investing is an important tool to both beat inflation (the cost of living) and to grow your wealth—whether to spend later in life or to give to your heirs or other entities. If you can grow your wealth at a rate greater than inflation, you would have what is called “real return”, which means that your investment didn’t just keep up with the cost of living, it actually grew at a greater rate than the cost of living. So, investing not only helps us to keep up but also to get ahead.

Your money today will likely buy you less milk tomorrow.[1]

There are two key phases of investing life: firstly, the investment accumulation phase (saving for retirement so we have money to live on) and secondly, the deaccumulation phase (the time when we need to begin spending our savings in retirement). We have seen how inflation always impacts our real returns, whether we are in the investment accumulation or deaccumulation phase. However, in the deaccumulation phases, we have an added challenge - the sequence of returns. The sequence of returns is exactly as it sounds: the order in which the returns of your investment occur. The sequence of returns is consequential when an investment balance is reduced as a result of withdrawals. Conversely, the sequence of returns has no impact on an investment balance that is not experiencing withdrawals. For example, if you have $1,000 invested and your returns for the next three years are 10%, -5%, 12%, respectively, you balance at the end of three years ($1,170) will be the same if your returns followed a different sequence, say, -5%, 12%, 10%. However, if you make withdrawals so that the investment balance is reduced each year, the sequence of returns will impact your investment balance (ideally you prefer high returns during years of a high investment balance). So when we are accumulating the sequence of returns is not an issue for the long term investor, however, in retirement, it is a very important consideration.

In conclusion: Invest for the long run and start early with whatever you can. Why? Because inflation and sequence of returns will be your foes when you are retired and drawing on your investments to maintain your lifestyle.

At Boerum Hill Financial Advisors, our clients understand that they need investment help, and are looking for guidance and want to learn. When developing investment strategies for clients we focus on what you can control and believe it will lead to a better investment experience. Together, we will:

- Create an investment plan to fit your needs and risk tolerance

- Structure a portfolio along the dimensions of expected returns

- Diversify globally

- Manage expenses, turnover, and taxes

- Stay disciplined through market dips and swings

“We have entered an era in which many millions of people need to make informed savings and investment decisions. The majority should not do so alone.” - William F. Sharpe, 1990 Nobel Prize in Economics [2]

For more information, or if you have questions, please contact me at This email address is being protected from spambots. You need JavaScript enabled to view it.

[1] In US dollars, Source for 1918 and 1968 Historic Statistics of the United States, Colonial Times to 1970/Department of Commerce. Source for 2018 US Department of Labor, Bureau of Labor Statistics, Economics, Consumer Price Index - US City Average Price Data.

[2] “Investors and Markets - Portfolio Choices, Asset Prices, and Investment Advice.” William F. Sharpe (winner of the 1990 Nobel Prize in Economics), Princeton University Press 2007, pg. 188