Investment Topics #3: Investing and Emotions

Many people try to predict the future and claim to have a proven system of picking winning stocks, or they claim to know which market sector will advance through the next year, or they know when the market will retreat. This can, and often will, result in investors acting on impulse - “The market is tanking, I’m getting out”, or conversely “everyone’s making money, I want a piece of the action”, the latter is often referred to as - Fear Of Missing Out (FOMO). This impulsive behavior can result in people betting their savings on tips and hunches - “I heard it on the news. I better sell”, “I got a hot tip from a neighbor. It’s a slam dunk”, or “My friend works in the industry, he’s got the inside scoop.” Similarly, we cannot forget the impact of the media in their desire to have an attention-grabbing headline to sell magazines -

“Will Coronavirus Cause a Recession?....” New York Times, 3/3/2020

“The Death of Equities” - Business Week, 8/13/1979

“The Crash of ’98 Can the US Economy Hold Up?” - FORTUNE, 9/28/1998

“Retire Rich - A Simple Plan to Have it All” - FORTUNE, 8/16/1999

“How to Reach $1 Million” - Money, 8/2012

When faced with short-term noise, it is easy to lose sight of the potential long-term benefits of staying invested. Adopting a long-term perspective can help change our view of market volatility and help us look beyond the attention-grabbing headlines of the day and hold us steady during severe market downturns.

Investing always comes with risk and reward, and it’s not that the reward makes us nervous, it is the risk that the reward will not arrive when expected. A disciplined investor is not going to look behind the media headlines and become anxious or feel enticed to chase the next top stock or the latest fad. Choose an investment journey that you are able to stay with. Similarly, long-term investors understand that equity market returns come with volatility, this is normal, and the market tumble we have just experienced can be a scary time for investors.

“The important thing about an investment philosophy is that you have one you can stick with” - David Booth[1]

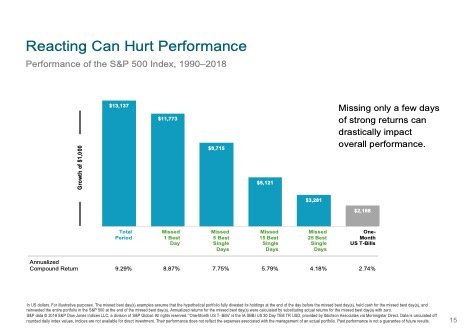

The chart below (Reacting Can Hurt Performance) demonstrates what the potential impact is of reacting to market volatility. In the twenty-nine-year period from 1990 to 2018, an investment in the S&P500 index of $1,000 grew to $13,137 an annualized compound return of 9.29%. Here’s the rub - If you missed the 1 best trading day in that period your return reduced by 0.42% to 8.87% (a 4.5 percent decrease); if you missed the best 5 single trading days your return reduced by 1.54% to 7.75% (a 16.6 percent decrease). Missing only a few days of strong returns can dramatically impact overall performance.[2]

Recently there has been panic in the markets caused by the feared spread and economic impact of the Coronavirus. A recent article from Dimensional Fund Advisors (DFA) had this to say - “We [DFA] can’t tell you when things will turn or by how much, but our expectation is that bearing today’s risk will be compensated with positive expected returns. That’s been a lesson of past health crises, such as the Ebola and Swine-flu outbreaks earlier this century, and of market disruptions, such as the global financial crisis of 2008–2009. Additionally, history has shown no reliable way to identify a market peak or bottom (emphasis added). These beliefs argue against making market moves based on fear or speculation, even as difficult and traumatic events transpire.” [1]

"In investing, what is comfortable is rarely profitable." - Robert Arnott

Emotions and investing do not mix well. There are many emotional reactions or biases that investors can act on that may have a negative impact on their investment experience, for example, we have a bias to avoid a loss rather than acquire a gain, this can result in holding losses too long and selling winners too quickly. Also, we can be too certain of our own judgment, falling prey to the quest for the “next hot stock “or excessive risk-taking.

“The most important quality for an investor is temperament, not intellect.” - Warren Buffett

How does one guard against acting on emotions when making investment decisions? Working closely with financial professional plays an important role in helping investors develop a long-term plan and an investment journey they can stick with. At Boerum Hill Financial Advisors we consider a wide range of possible outcomes, both good and bad when helping an investor establish an asset allocation and plan. Those preparations include the possibility, even the inevitability, of a downturn. Our clients are willing to accept guidance and want to learn and are candid in describing their needs and expectations. When developing investment strategies for clients we focus on what you can control and believe it will lead to a better investment experience, these include:

- Create an investment plan to fit your needs and risk tolerance.

- Structure a portfolio along the dimensions of expected returns.

- Diversify globally.

- Manage expenses, turnover, and taxes.

- Stay disciplined through market dips and swings.

“We have entered an era in which many millions of people need to make informed savings and investment decisions. The majority should not do so alone.”[2]

For more information and a free consultation, please contact me at This email address is being protected from spambots. You need JavaScript enabled to view it.

[1] Dimensional - The Coronavirus and Market Declines, Feb. 27, 2020

[2] “Investors and Markets - Portfolio Choices, Asset Prices, and Investment Advice.” William F. Sharpe (winner of the 1990 Nobel Prize in Economics), Princeton University Press 2007, pg. 188

[1] Executive Chairman, Dimensional Fund Advisors

[2] The S&P500 increased by 19.3% in the period March 23 to 26, 2020 (2,191 to 2,615) source Yahoo finance