Small Business Tax Planning 2019

Getting close to December 31

Federal state and local taxes are up there with your biggest bills, about one-third of all you earn in your lifetime is going to be paid in taxes, so it makes sense to plan ahead and make sure your tax bill is as low as possible. Being a business owner or self-employed provides greater opportunity for tax-planning when compared to the salary and wage earner. Your goal is to minimize your tax bill (cash outflow) or defer your tax bill to a future period. Yes, tax planning can seem complicated, it involves planning for your retirement, tax installment payments, keeping up-to-date and accurate records and managing a key component of your cash flow. Tax planning also comes with the temptation to underreport earnings, what I refer to as “crossing the line”, but there is no need to put skeletons in your closet, you’ll sleep better, and your life will be less complicated. A former boss and President of a public company gave me some very sage advice early in my career:

“If you can see the line you are too close.”

When making business decisions it is always best to focus on the economics of the deal and to keep any tax considerations as a secondary consideration, that is, the deal should make sense before you factor in taxes. This is what the good big companies do, avoid going near the line when making business decisions, and it is also good business sense for small business.

What to do?

When faced with tax planning our response is either a glazed look, or we see it as a challenge and get into it, and everything in-between. So, no matter what your response is I have listed below ten valuable tax planning ideas for you to consider.

1. Please do not wait until 2020 to plan your 2019 taxes.

Waiting until just before April 15, 2020, to start thinking about your 2019 taxes may prove to be a costly mistake. Starting now will take the stress out of the task and give you time to consider options and trade-offs and make informed decisions.

2. Start your tax planning by making a rough estimate of your business income for the year

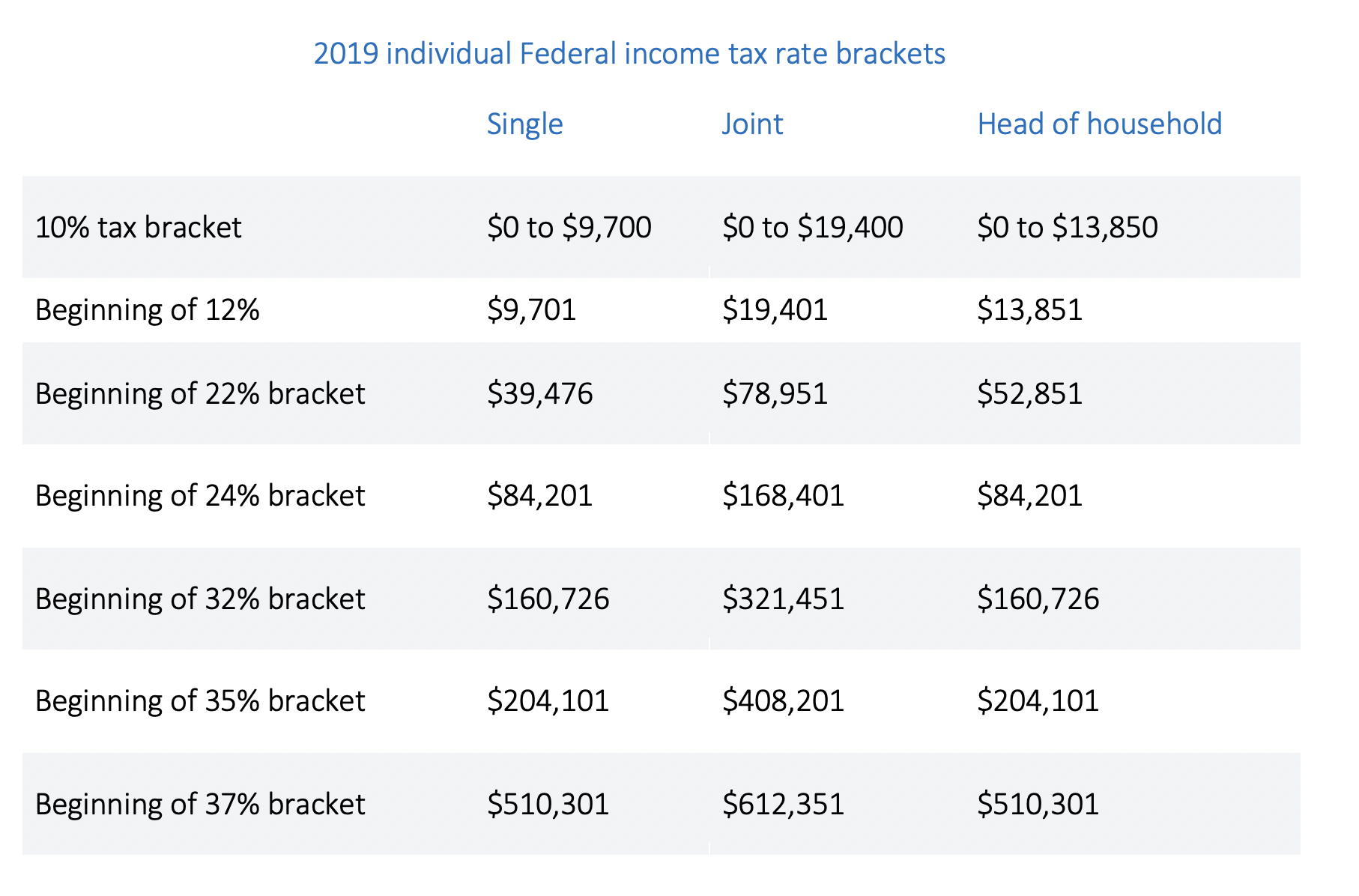

Being a small business owner or self-employed your first need is a rough estimate of your income and expenses for the year. You do not have to be exact; the goal is to determine which tax bracket you are likely to fall into this year. The 2019 tax brackets are detailed below:

3. Forewarned is forearmed - use a tax calculator to give you a rough estimate of federal tax

Once you have an idea of what your 2019 taxable income will be you can now do a rough “What if” exercise using a tax calculator https://www.dinkytown.net/java/1040-tax-calculator.html. This application allows you to enter your estimated business income and get an idea of what your federal tax bill will be and your likely tax bill (cash outflow). At this point, you can compare your results with your prior year filing.

4. Time your Business Income and Tax Deductions

Now you are armed with an estimate of your taxable income for 2019, there are things you can do before December 31 to impact your 2019 taxable income and your final tax bill. Firstly, as you are probably reporting on a cash basis, you do not have to report income until the year you receive the cash, or the check is in hand. So, if you want to reduce your taxable income you can wait until January 2020 to bill some of your clients, this income will be reported as income in your 2020 return. Also, you can accelerate deductions by making tax-deductible purchases for items you will need in the following year, for example, a large expense item could be your January and February 2020 rent paid December 2019.

5. Qualified Business Income Deduction 20% (QBI)

The new qualified business income (QBI) deduction from pass-through entities is available for tax years 2018-2025. The deduction can be up to 20% of a pass-through entity owner’s QBI. There are limitations on the QBI deduction, so tax planning initiatives can increase or decrease your QBI deduction. I recommend you work with your tax advisor to optimize your QBI deduction and overall tax bill.

6. Deferred Tax Retirement Accounts.

I discussed in a previous blog the advantages of a solo 401(k) plan when compared to a SEP-IRA plan. Unlike a SEP IRA, you must set up the Solo 401(k) account before December 31, 2019, to make contributions for the 2019 financial year. Let me illustrate the difference between the two retirement accounts. For example, if in 2018 you have a business income of $100,000 for the year and you were less than 50 years of age you were able to contribute up to $37,087 to your solo 401(k) compared to a maximum contribution of $18,587 for your SEP IRA. Nice to have the flexibility and choice.

7. Roth Conversions

I’m a fan of Roth IRAs because the balance grows tax-free and distributions are also not taxed (when you follow the rules). Depending on your taxable income level it may be wise to convert part of your traditional IRA to a Roth IRA. Although you will pay tax on the amount converted to a Roth, your Roth account will grow tax-free and funds, when drawn from your Roth will be tax-free and not subject to a mandatory distribution (Required Minimum Distributions (RMD)) as in the case of your Traditional IRA.

This is the quickest way to get a significant sum into a Roth IRA. The conversion is treated as a taxable distribution from your traditional IRA because you’re deemed to receive a payout from the traditional account with the funds then going into the new Roth account. Traditional IRA to Roth IRA conversion must be completed by December 31 to count for the current tax year.

8. Health Saving Accounts (HSA)

If you enrolled in a high-deductible health plan in 2019 and you have the funds, it is a good idea to contribute to an (HSA), the maximum allowed contribution for 2019 - Single $3,500, Family $7,000 these contributions increase by $1,000 if you are over the age of 55. Your contribution is tax-deductible and can be invested and the growth is tax-free and withdrawals are tax-free if used for qualified health care expenses. You have until April 15, 2020, to make contributions for 2019.

9. Donor-Advised Funds (DAF)

A DAF represents a simple philanthropic avenue for the owner that provides significant

tax and cash flow benefits, a smart and meaningful strategy for creating a charitable legacy. If you have significant capital gains and wish to maximize your charitable giving a DAF is a valuable vehicle for doing just that.

In brief:

- DAF is the most popular philanthropic tool in America today

- The donor contributes a wide range of asset types to a named fund

- The gift qualifies for immediate and maximum tax benefits

- The assets are placed in an investment account which you manage

- The donor recommends grants to favorite charities at their convenient time

- The fund can go on as the family’s charitable legacy over successive generations

Example:

- A stock with a significant capital gain e.g. cost - $100, market value $250.

- Contributed to DAF, an immediate tax deduction for market value - $250, No capital gains tax due.

- The Donor distributes from the fund to charity as and when they desire.

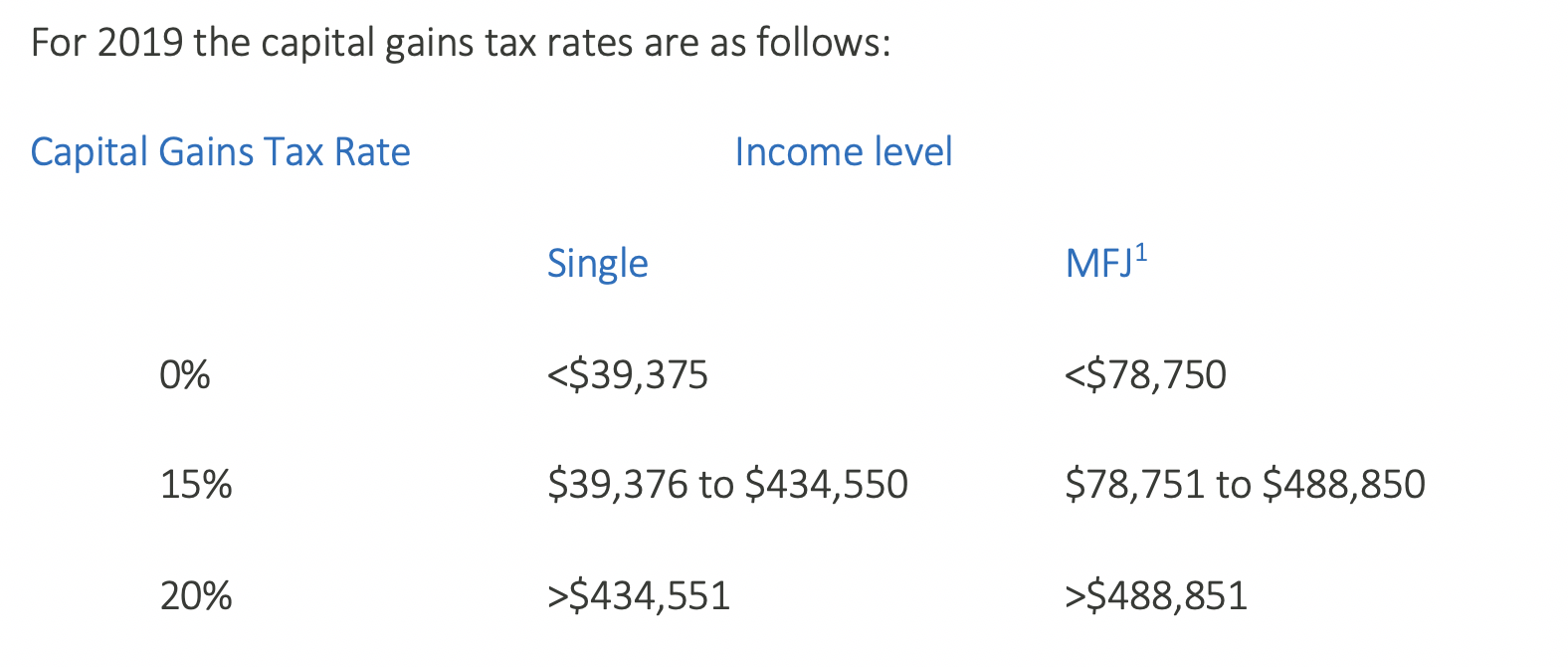

10. Capital Gains Tax

All capital gains and losses realized for tax minimization purposes are important activities in investment portfolio management. Accordingly, these strategies should be performed in the context of your investment portfolio goals and in conjunction with your financial advisor.

If for 2019 you are at the 0% capital gains rate now, or at the 15% capital gains rate but expect your income to be higher in future years, you may want to realize capital gains now at the lower rate. If you have been thinking about selling assets that have declined in value, now may be the time to act. Sale of capital losses can be used to offset realized capital gains. In addition, up to $3,000 in losses can be offset against ordinary income. If losses exceed this amount, they can be carried forward to future tax years. (Technically the way it works is short-term losses are first deducted against short-term gains and long-term losses against long-term gains. Net losses of either type can then be deducted against the other kind of gain.)

Do you want to talk to your Financial Advisor or Your Accountant?

Preparing for one of your biggest cash outflows is important. Just like setting your financial goals, realistic expense planning, tax-efficient investing, and maintaining safe debt levels. These topics are very easy to postpone, and many times people make major financial decisions without sound advice, which may delay or eliminate options and choices for the future. These are areas where a trusted financial advisor can be of great value to you, someone that can provide you with support, objective advice, and keep it real and understandable. Finding the right financial advisor for you is not easy. If there is one thing my clients know, and that is, I care.

For a free no-obligation “get to know meeting”, please email – This email address is being protected from spambots. You need JavaScript enabled to view it. I look forward to hearing from you.

[1] Married Filing Jointly