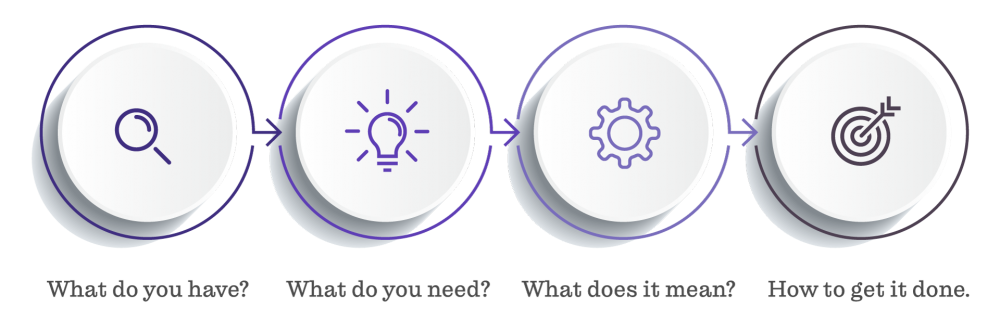

Financial Planning Process

The context of planning can easily change and financial options can be complex. Formal plans, structure, diagnose, analyze and recommend can make a client and advisor feel comfortable, but in the end, the delivery of a 20-page financial plan may not be helpful. I have found that a strong relationship between the client and advisor facilitates collaborative decision making often results in fast real help. Planning often takes the form of adaptive moves. Adaptive as there is often no single problem; Moves, because there is often no quick fix or master plan solution. Rather there is ongoing integration between the client and advisor leading to a series of adaptive moves.