Wednesday, 20 March 2024

‘Gray Divorce’ and Important Implications to Consider

The season of spring leads many of us to want to dust off the weariness of winter and freshen things up. As the new season approaches, you may also want to think about freshening up your finances. Perhaps you made some financial resolutions in the New Year, and now is a great time to revisit those and reassess your finances. Between the doldrums of winter and the new season ahead, you may find that there are some financial strategies or decisions that no longer serve your goals. Below, we’re sharing seven spring money tips to help you get started.

Monday, 05 February 2024

‘Gray Divorce’ and Important Implications to Consider

Facing a divorce after the age of 50, especially as you near retirement, can be especially fraught with financial implications you may not have considered. Even if you’ve been anticipating this significant life transition, often referred to as “gray divorce”, it may not have been a part of your retirement plan. While divorce at any age impacts just about every part of your life, the financial impact of divorce can be especially stressful at this stage. Understanding the many factors that must be thought of can be helpful as you move through this difficult time. In this article, we review many considerations regarding the financial impact of divorce and provide some guidance as you navigate divorce after 50.

Wednesday, 03 January 2024

The coming of a new year inspires much thinking and planning. You may be looking for ways to structure and organize your life to be prepared for a brand-new year, especially when it comes to your personal finances. As you plan your money moves for 2024, it’s important to consider both short- and long-term goals. It’s also beneficial to arrange finances for emergencies or unexpected situations. How should you plan your money moves for 2024 to ensure economic stability and prosperity? Here are key strategies to consider.

Monday, 18 December 2023

Losing a spouse is a devastating experience. The emotional toll is difficult enough, but many widows also face looming challenges to their finances. According to the most recent data available from Congressional Research Services, 15.5% of widows aged 65 or older live below the poverty line, compared to 5.8% of married women. While there’s a lot that the recently widowed must process, it’s important to take a few key steps to ensure financial stability for the future. With that in mind, here are three financial resolutions for widows to take in 2024.

Tuesday, 21 November 2023

The holiday season is often portrayed as a time of joy, togetherness, and celebration. However, for many people, it can also be a source of financial stress and anxiety. The pressure to buy gifts, host gatherings, and partake in festivities can lead to overspending and financial strain. But fear not, there are practical ways to navigate financial stress during the holidays and enjoy the season without breaking the bank.

Wednesday, 18 October 2023

With the transformation of the leaves and a cool, refreshing breeze, fall offers more than just Pumpkin Spice everything. It's an annual opportunity to contemplate your financial aspirations and lay the foundation for a more secure future. Much like farmers attentively nurture their fields before winter, you too can cultivate your finances to enter the new season on a high note. If you're eager to fortify your finances before the winter chill sets in, continue reading for fall financial tips that can yield a plentiful harvest for your future financial security.

Wednesday, 06 September 2023

Tax season often brings a mixture of anticipation and anxiety for individuals and businesses alike. However, with careful planning and strategic thinking, you can minimize your tax liabilities and make the process smoother for yourself. Getting a head start on optimizing your tax strategy now will not only help you save money but also ensure that you're well-prepared for the upcoming tax season. In the article below, you’ll find ten tips to consider as you begin your tax planning preparations.

Monday, 28 August 2023

“If you don't know where you're going, you might not get there.” Yogi Berra

You’ve Arrived!

Whether your retirement is planned, or you were gently nudged it can often be a bigger deal than you expected. I meet people who are approaching their retirement years who have managed to save a substantial amount...then comes the big question – “How can I both enjoy my retirement and not run out of money?”

How do retirees run out of money?

Monday, 14 August 2023

Tips to Avoid Seasonal Overspending This Summer

So many of us look forward to summer fun all year long. It’s a season associated with vacations, outdoor activities, and social gatherings, too. Of course, this often means we’re spending more money than usual, which can have long-term implications if we aren’t careful. So, while there is nothing wrong with enjoying the summer, it's crucial to be mindful of the impact that summer overspending can have on our future financial health. In this article, we will explore the reasons behind increased summer spending and discuss strategies to maintain a balance between enjoying the season and protecting your financial well-being.

Monday, 26 June 2023

What You Should Consider Before Making This Significant Purchase

When it comes to managing your finances and making prudent investment decisions, one option that may have captured your attention is potentially purchasing a vacation home. The allure of owning a second home in a desirable location can be quite enticing, but is a vacation home truly a smart investment? In this article, we will explore the considerations and factors you should evaluate within your personal financial circumstances before making the decision to invest in a vacation home.

Wednesday, 21 June 2023

Six Steps to Prepare for Long-Term Success

Graduating from college is a major milestone, but it can also be a daunting time for many young adults as they transition into the "real world". If you have a recent college graduate in your life, they may be facing a number of financial challenges, from student loan debt to finding their first job. Financial planning may be the last thing on their mind, but you can use your influence and experience to help them see the benefit of taking financial planning steps as a recent college graduate in order to set themselves up for long-term success.

Share the six steps below to help them get started.

Tuesday, 23 May 2023

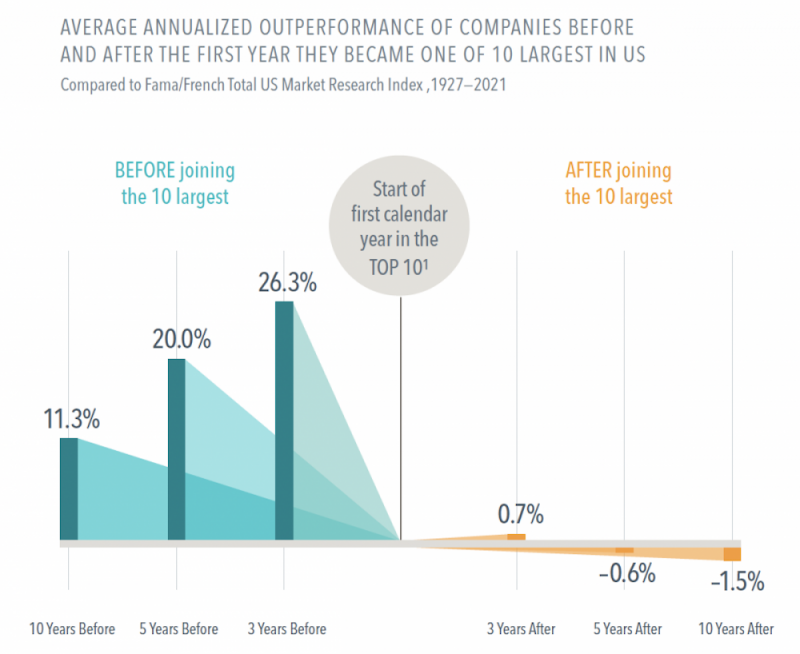

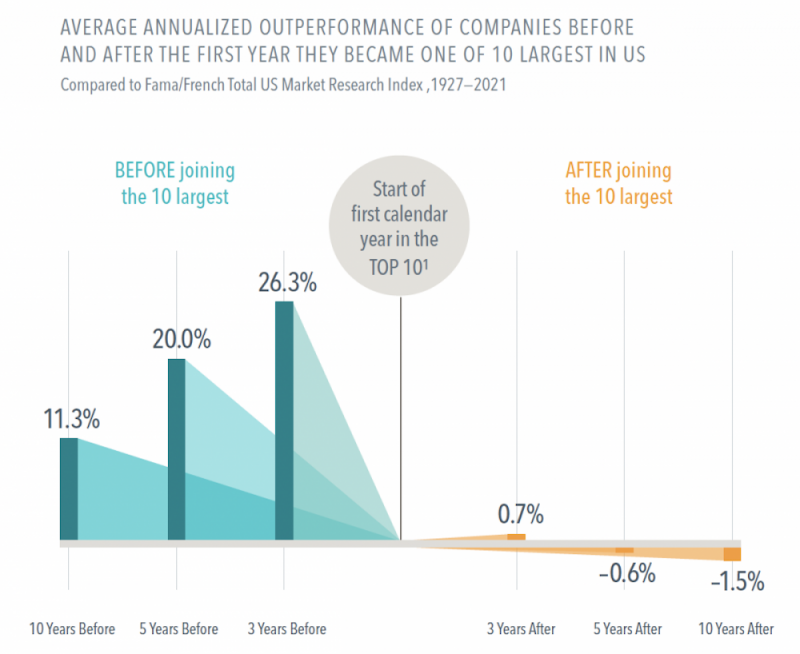

As companies grow to become some of the largest firms trading on the US stock market, the returns that push them there can be impressive. But not long after joining the Top 10 largest by market cap, these stocks, on average, lagged the market.

Monday, 01 May 2023

| Learn the Benefits and Drawbacks of Both Options

Are you wondering about the benefits and drawbacks of paying off your mortgage vs. investing? Paying off your mortgage early and investing more are both strategies that can help you achieve long-term financial stability, but it can be difficult to determine which goal to prioritize. In this article, we'll explore the pros and cons of both strategies to help you determine which may be the best for your financial future.

Tuesday, 18 April 2023

| Navigating High Inflationary Periods and Protecting Your Wealth Over Time

Inflation is an economic concept that describes the increase in the cost of goods and services over time. As inflation rises, the purchasing power of your money decreases – which you may feel in your daily life. However, it can also have a significant impact on your long-term wealth management and investment strategies. In this article, we'll explore how inflation impacts wealth management and investment strategies and provide tips on how to navigate inflationary periods.

Monday, 27 March 2023

Avoid These Missteps and Get on the Path Toward Building True Wealth

Having a high income can certainly make you feel wealthy. Maybe you’re enjoying a sprawling home, a fancy car, and the latest technological gadgets. However, what too many high earners fail to realize is that true wealth is much more than just a big paycheck that comfortably funds your current lifestyle. If you’d like to leverage your high income to establish long-lasting wealth and financial security, avoid the five common mistakes below.