Wednesday, 04 September 2019

You have to be special to be a performing artist, and unlike many others, you are going to earn a living from your passion. The question is, how is this going to be possible?

“Artists are the gatekeepers of truth. We are civilization’s radical voice.” – Paul Robeson

It is easy for us “civilians” to underestimate the tenacity, drive, persistence, and energy of the performing artist, and that they only know to give 110%. They are entrepreneurs, idealists, and they understand that job security is not there for them and, as a result, they hustle to generate several sources of income to pay your way. A study in 2016 [1] estimates alternative work arrangements comprise 16% of the workforce in 2015, up from 10% in 2005. This work life is often referred to as the “gig life” (e.g., freelancer, independent contractor, on-demand or temporary worker, and excludes those who rent an asset (e.g. Airbnb) or sells goods they produce (e.g. Etsy)). You are the original members of a fast-growing group in the workforce.

Wednesday, 04 September 2019

How do you roll? Have you discovered that if you want to help someone to do something new or differently, you had better know something about how they “roll”?

Each of us has preferences, boundaries, biases, experiences, and beliefs about money that all play a role in the daily decisions we make. Let us call our beliefs about money “money scripts”. These money scripts are hard-wired belief systems, our automatic pilot settings that make for quick decisions. Here are some money scripts[1] examples that may be familiar to you:

- “It is/is not important to save for a rainy day.”

- “It is okay to keep secrets from your partner around money.”

- “If you are good, your financial needs will be taken care of.”

- “It takes money to make money.”

- “I will never be able to afford the things I really want in life.”

These scripts (belief systems) play an important role in determining our behavior when it comes to money. Some of these behaviors can be destructive when it comes to money management and achieving our financial goals...

Monday, 12 August 2019

SO MUCH OF THE FINANCIAL ADVICE AND RESOURCES OUT THERE IS FOCUSED ON MARRIED COUPLES.

I received a lot of positive feedback from the “Single and Loving It” article. “I really loved that blog”, “I never see anything written for me...Finally!”, “can you write another one?”, “I’m never really sure if I’m doing the right thing with my money, retirement, savings”, “There’s a lot of us out there that needs this!”

Single and Loving It: Part II

Startups

Many single adults are employed by startups, which often do not provide workplace 401k or 403b. So, what should a startup employee do? In 2019, an employee can contribute $19,000 per year to an employer 401k or 403b, however, if these are not provided by your employer an individual can only contribute $6,000 pa to a Traditional Individual Retirement Account (IRA). That’s a big difference, $19,000 vs $6,000, and all the more reason for starting your retirement savings early. I often give this example to highlight the value of starting early:

Monday, 29 July 2019

I like to walk my neighborhood and see the businesses that have stayed the course, popped-up and who has moved on with the times.

I like to walk around my Brooklyn neighborhood. I notice the businesses that have stayed the course or have recently popped-up and those that have moved on with the times. Walking down Atlantic Avenue, Brooklyn, I see the cabinet maker’s workshop, then there is the fine art picture framer whose main clientele are museums, the new coffee and Wi-Fi spot, and the Urban Outfitters building still with its 1859 decal “Sale Makers - Canvas Goods”. Not to mention the many restaurants.

Wednesday, 17 July 2019

"I have found that the importance of having an investment philosophy—one that is robust and that you can stick with— cannot be overstated."

David Booth

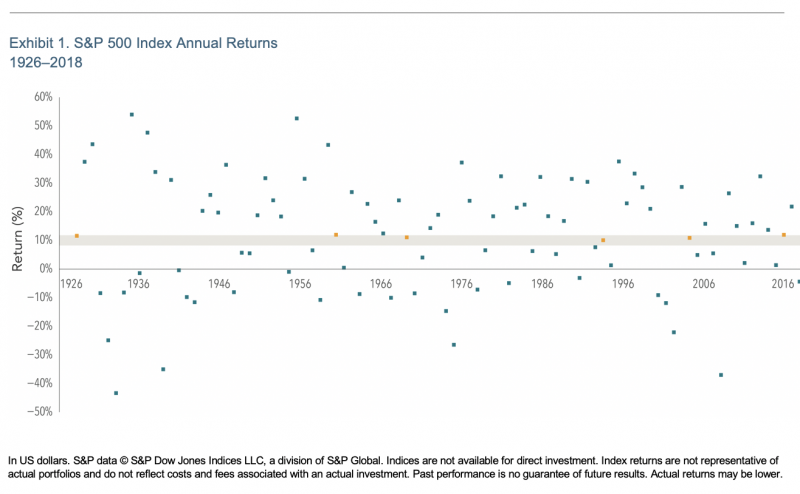

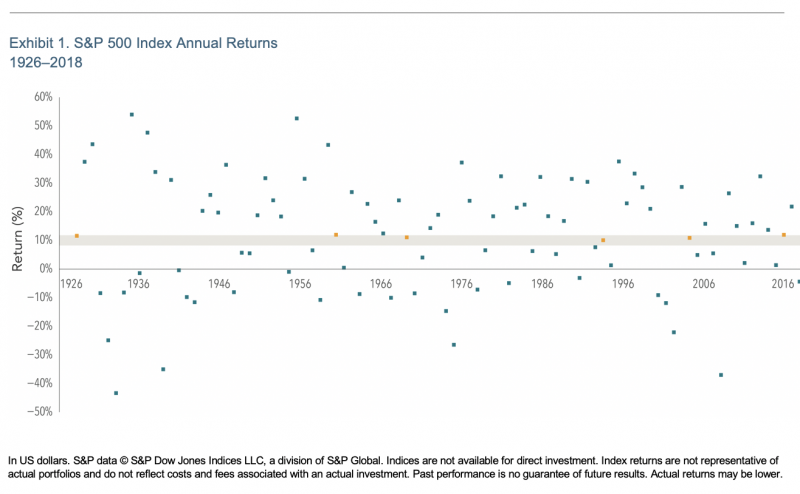

The US stock market has delivered an average annual return of around 10% since 1926. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat. When setting expectations, it’s helpful to see the range of outcomes experienced by investors historically. For example, how often have the stock market’s annual returns actually aligned with its long-term average?

Monday, 08 July 2019

There is a lot of advertising for annuities today. Many people feel a little skeptical about these financial products. Be warned: This topic can be a little dry, so let me say at the outset that this blog post is most relevant for those near or in retirement. Here we go: “Are annuities a good idea for you?”

Before we continue, please let me emphasize that I’m a fiduciary fee-only financial advisor, which means I do not receive commissions directly or indirectly on the sale of a financial product. As a fiduciary, I put my client’s needs first, always. Also, this blog post is not a recommendation to buy or sell an annuity; rather, it is an outline of my approach to annuities, and the things to consider when evaluating them. As always, before purchasing any investment or insurance product, be sure to do your own due diligence and consult a properly licensed professional should you have specific questions as they relate to your individual circumstances.

Tuesday, 25 June 2019

One has to trigger that “eureka” moment – “Ah ha, I want this, I’ve got this.” The question then becomes: How can a financial planner achieve this for you?

Recently I was in Brooklyn giving directions to a friend. Simple directions: “Go west on Atlantic, take the second right and then look for the TD Band on your left.” My friend understood the directions but the look on his face made me feel that he was not going to get there. I said to myself, I need to make this meaningful and memorable. So, I told him, “Go this way, then turn right at Trader Joe’s.” It was a “eureka” moment as his face lit up and I knew that he would make it to his destination in no time. That’s what it is like with financial planning--it may not be difficult to give and receive clear and logical instructions, but it doesn’t always mean that someone will get there. One has to trigger that “eureka” moment – “Ah ha, I want this, I’ve got this.” The question then becomes: How can a financial planner achieve this for you?

Monday, 17 June 2019

Introduction – A Brooklyn healthcare worker and artist

Let me tell you about a healthcare worker that purchased a three-level walkup in Boerum Hill, Brooklyn in the early 1980s at a cost of $35,000. She wanted an easy commute, was prepared to “deal” with the neighborhood, and she wanted to own and collect some passive income. The property is now worth $4.5 million (that is a CAGR of 14.0%). In the same neighborhood, a couple purchased a similar property primarily so they could afford an art studio, they also experienced enormous growth in their residential property value. In New York City, and no doubt other cities around the country, there are many property owners entering retirement with significant home equity wealth. Your retirement portfolio can be made up of the following - residential equity, deferred tax...

Tuesday, 21 May 2019

Sell in May and Go Away Was A Bad Idea in 2018.

If you sold out of the market Last summer, you missed a 10% increase.

“Sell in May and go away” is an old Wall Street saying that suggests investors to sell their stocks during the summer to avoid a seasonal decline in the stock market. An investor selling their stocks in May would then buy stocks again at the end of the summer (some suggest November) because the summer time-period shows significantly less growth in the market than the other times of the year. Or so the story goes.

Friday, 03 May 2019

So much of the financial advice and resources out there is focused on married couples.

Unfortunately, the disparity in information for those seeking financial advice as single people is doing a great disservice to the middle-aged single community. Retirement saving advice, financial planning, and investment strategy can sometimes be different for those who are single versus their married counterparts. Since 1990, divorce rates have doubled for those 50 and above. That means there will be many more adults entering retirement single or divorced and this article will go over some specific tips for you.

Thursday, 25 April 2019

So much of retirement planning focuses on the money, but that is often part of the process, not the whole process.

So much of retirement planning focuses on the money, but that is often part of the process, not the whole process. On top of that, while retirement planning can often be a stressful activity, the truth is, the process can be enjoyable both for you and your partner if you come at it from the right perspective. In this article, we will go over five steps you can take to get on top of your retirement planning. Obviously, the earlier you do this, the better. Considering 1/3rd of Boomers have little to no savings and fewer people receive any kind of workplace pension, that is a lot of people who may find real hardship once retired. Much like the story of the grasshopper and the ant saving up for winter, with a little time and preparation, you can avoid real hardships up ahead.

Thursday, 11 April 2019

Financial Planning Isn’t Only for the Rich

How are your finances? If that question makes you want to run screaming into the woods, good news, you're not alone! In fact, Americans, as a people, aren't very good at managing their finances. We've racked up $92 billion in credit card debt as of 2017 and 1 in 4 people report having more credit card debt than savings. We owe $1.5 trillion in student loans. On top of that 55% of people feel lost when it comes to long-term saving and stable financial plans. That adds up to a lot of people wandering the financial landscape lost and ill-prepared for the future. The good news is, this course can be corrected. This article aims to help get even the most confused or debt-laden onto a better financial path. Becoming financially stable is not only good for your bank accounts and bills, but it's also actually good for you - Mind and Body. Being in debt is stressful, it puts strains on relationships, makes it harder to buy homes, change careers, or recover from unforeseen life-events. On top of all that, being stressed about money is bad for overall health. On the flip side, financial security can be beneficial to your overall mental and physical well-being.