Budgets and Breaking Through Barriers

How do you roll? Have you discovered that if you want to help someone to do something new or differently, you had better know something about how they “roll”?

Each of us has preferences, boundaries, biases, experiences, and beliefs about money that all play a role in the daily decisions we make. Let us call our beliefs about money “money scripts”. These money scripts are hard-wired belief systems, our automatic pilot settings that make for quick decisions. Here are some money scripts[1] examples that may be familiar to you:

- “It is/is not important to save for a rainy day.”

- “It is okay to keep secrets from your partner around money.”

- “If you are good, your financial needs will be taken care of.”

- “It takes money to make money.”

- “I will never be able to afford the things I really want in life.”

These scripts (belief systems) play an important role in determining our behavior when it comes to money. Some of these behaviors can be destructive when it comes to money management and achieving our financial goals. The most common destructive behavior is overspending (Retail therapy, buying on impulse, "I want it", "I work hard", "I deserve it", "Everyone else has one", or "I had a really bad day”). Other destructive behaviors include avoiding thinking about money and living in financial denial, hoarding stuff, lying to your partner about money, poor investment decisions, and taking on too much risk.

What have these scripts got to do with my household budget? All of these behaviors make keeping a budget almost impossible. It is important to keep in mind the power of belief systems over budgeting. If you know that you have a problem in this area but can’t seem to get over it, seeking the help of a financial planner could save you money and help reduce your stress.

Budgets: The Basics

No doubt at some time in your life, you probably have heard about the importance of a household budget. In fact, it is probably one of the best tools to help you control your personal and household expenses, ensuring that you are living within your means, saving money for a rainy day, using debt wisely and adequately fund your retirement for a life of dignity and independence. Having a budget and sticking with it is an indispensable skill that you will benefit from for the rest of your life. A budget is more than just controlling expenditures, it is also about:

- How you employ all sources of income

- Curbing excess spending

- Creating practical spending limits

- Anticipating emergencies

- Using debt wisely

- Meeting your savings requirement

Budgets for the Single, the Couple, the Family, the Self-employed, and the Retiree.

“Is every budget difficult or is it me?” Not all budgets are difficult, and no two budgets are the same. The family budget is arguably the most difficult one to prepare and manage because there are lots of moving parts. These often consist of two or more income streams and many large cost items, such as house, car, college funds, retirement, family vacation, summer camps, braces for the kids, and so on. In addition, a family budget takes at least two people to align, everyone bringing their own money scripts. Similarly, a couple’s budget is challenging because the two partners need to reconcile their individual money scripts in order to agree on a budget. If you find yourself in that situation, think of it as an opportunity to leave some of your money scripts behind and work on creating new ones together. Creating a safe space for money discussions is important for couples because the absence of discussions can end up in money secrets, which is something to avoid. The singles budget, on the other hand, is simpler. All the decisions rest on you—there is no one else to negotiate with. However, it has its own challenges and accountability needs. Self-employed people have a big need for a budget and the unique challenges that go with their situations. Let’s say you are self-employed, a dancer or an opera singer in New York City, working part-time jobs to pay your bills and earning a good wage while your show is running. You will need to establish an emergency fund or “cash-float” to carry you through those low-income periods. You will also need to ensure you are putting funds aside for taxes. This can be a real challenge and stressful (but nothing like an audition). For the retirees, the complexity of the family budget is behind you, along with your money script differences (I hope)—but don’t forget, you still need to save some and be flexible with your spending if you have a dependence on how the markets perform. Sacrifices are still required sometimes—for example, you may need to skip the vacation in some years. I often use the retiree as a mind-set to focus a client on preparing a budget: “Imagine you had a fixed amount of money to last you for the rest of your days, you are in good health but going back to work was not an option for you, how would you go about preparing your budget?”

Where are you? How did you get here? Do you want to stay here?

Taking control of your finances is about having a budget that works for you. Your aim is to find a system that will get you to where you need to be and that is easy for you to stick with; in other words, a budget system that works for you, not against you. A good starting point is to ask the question “Where am I now?” If you do not know where you are, it’s going to be difficult to get to where you want to go.

Now is the time to take stock, to see the big picture and answer the question “Where does my money go?” This can be an overwhelming question and is easy to put off—fortunately, there are tools available to make this process less daunting. To make this easier for my clients, I introduce them to a personalized financial tool that makes it easy to see, at a glance, where their money comes from and where it is going. Some people already have a personal accounting system, which may involve a spreadsheet or a manual summary of some kind. Whichever tool you use, the important thing is to have an accurate picture of your money activities, which is the starting point for budgeting. Remember: “Money is neither created nor destroyed, it just changes hands” - Anonymous.

How much do I have to budget?

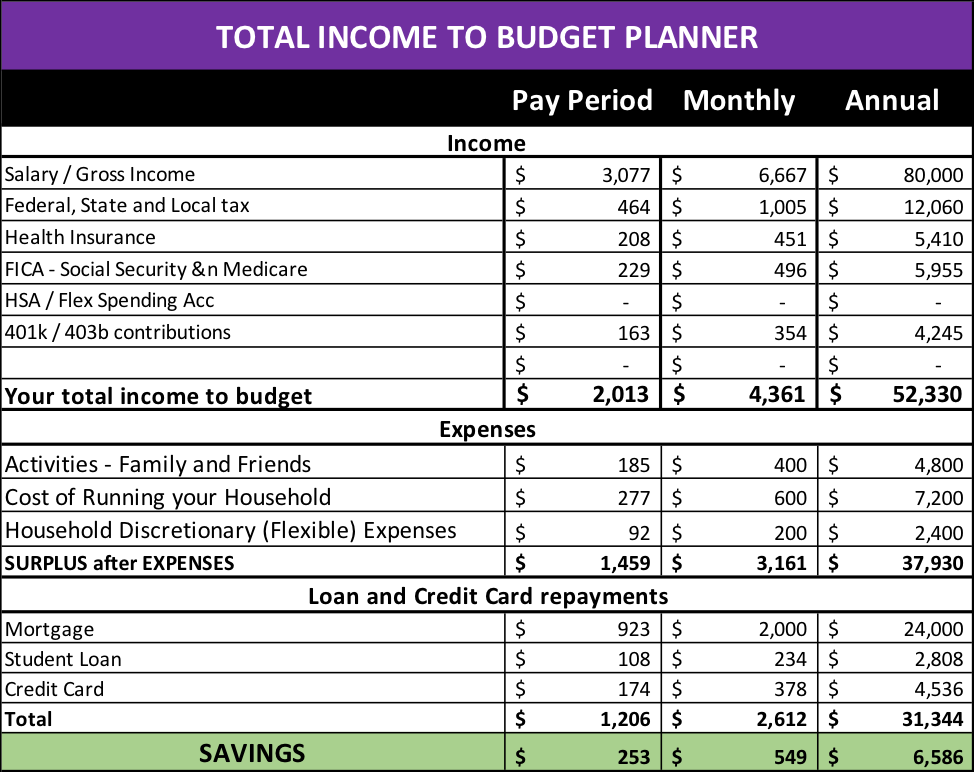

The most common budgeting approach is called a bottom-up budget process. One starts off by listing what they spend their money on, by pay-period, monthly, or yearly. However, this approach can easily omit expense items and make you think you have more than you really do. To overcome this, it is important to use a top-down approach as well, which starts off by looking at what you have to budget, i.e. your total income after taxes and other payroll deductions is what you have available to spend and to save. It is important to use both a top-down and a bottom-up approach to building your budget.

In this example, the person has $52,330 to budget for the year, or $4,361 a month and $2,013 per pay period. They then deduct their household expenses and their loan repayments, which leaves them with what is available for savings, and in this case $6586 per year. An important thing to remember is that your spending may be greater than your income because you have borrowed money. That’s a spiral we want to stop: more spending, more borrowing on the credit card. Any amount you borrow must be repaid in the future, which reduces what you can save and/or spend.

Establishing Your Emergency Fund

The first task for your budget is to create your Emergency Fund for rainy days: times of unemployment, a medical emergency, a major repair, relocation, a once in a lifetime opportunity, a family emergency and so on. This is your buffer for what life throws at you, which is not a matter of if, but when. It doesn’t matter how good your budget is—if you don’t have an emergency fund, your budget will fail at some point. The emergency fund is the foundation for your budget and has both a psychological and a financial benefit; it not only is a financial buffer, but it is also your stress buffer. Without it, you may need to access cash from your credit card, or sell something, or even draw from your 401k/403b, or an IRA. These options are not good and are expensive because they come with high-interest rates, opportunity costs, and penalties. You will forgo the benefit of compound interest in your investments, and there are tax penalties for early drawings from your retirement accounts—all of which we need to avoid wherever possible.

How much of an emergency fund should you have? Aim for an emergency fund with at least three to six months of essential expenses (mortgage/rent, utilities, loan repayment, insurance, living essentials, etc.). If you are older, I recommend having at least six months of essential expenses in your emergency fund, because finding employment can take longer the older you are. Here is an example: Let’s say your essential monthly expenses total $4,200. Six months X $4,200 = $25,200 is your Emergency Fund. Your emergency fund needs to be in a separate account, not mixed with the day-to-day cash flow activities, and it should be liquid (easily accessed within 30 days without penalty).

The Benefits of a Budget

Your budget can help you to anticipate financial problems and therefore allow you to remedy the situation in advance. Anticipation is a key skill in financial management—whether of a company, a small business or a department of your own finances. Your budget will help you recognize the need to work on an alternative course of action to achieve your financial goals; for example, downsizing a home or a car, delaying a major purchase, making a change in the type of vacation you are planning, and so on. A budget can motivate you to adhere to a savings plan because it is a goal you want to achieve. Finally, your financial success will depend on living within your means, using debt wisely, keeping your emergency fund intact, achieving your savings goals and keeping your eye on the long-term. This can be difficult, but the help of a financial expert can make it easier for you. Like anything in life, there are challenges and we can’t know everything or see into the future, so we need to do our best to be prepared, and not move from one financial crisis to the next. Knowing that a trusted professional with your best interests in mind can leave you space to feel secure and enjoy your retirement when the time comes.

[1] B Klontz, T Klontz and R Kahler – Wired for Wealth.