Dimensional On: Recent Market Volatility

Tuesday, 10 March 2020

Why investors should view recent market declines as part of the nature of investing

Tuesday, 10 March 2020

Why investors should view recent market declines as part of the nature of investing

Wednesday, 25 March 2020

Today, unlike before, it is proving difficult to give ourselves a health break from all the doom and gloom. In other difficult times, we were able to grab a drink with a friend after work, hit the gym for an intense workout session, get away for the weekend, or have some fellowship at our places of worship. Guidelines recommending social distancing and state-mandated lockdowns have made it difficult for many of us to manage our stress in typical ways. Accordingly, it is important to stay connected with your friends and family and check-in on each other on a regular basis.

“It is health that is real wealth and not pieces of gold and silver.”

—Mahatma Gandhi

Small business owners are no strangers to tough times and are hard-wired to meet a challenge head-on. I have been speaking with clients, business owners and friends about what they are doing to get by and survive during this time. Last week I published - “COVID-19 Ten Ideas on What to do” and received a positive response from people so I have written this article for small business owners. I hope is a useful tool and helps you to navigate through this unfamiliar storm where everything seems to be all over the map.

Wednesday, 18 March 2020

What we do in response to the spread of COVID-19 is largely driven by how we choose to impact others. As a society, we want to ensure that everyone who gets sick from COVID-19 has access to the care they need, which includes health professionals who are healthy and well. Like many people, I’m hunkered down in my apartment, which is also my home office, keeping my social distance. What can I do to help in this situation? I believe a good stress reduction technique--and we all could use a little less stress right now--is to think about how we can safely help others. Below I have listed ten helpful ideas to consider at this time that can help you and others.

Tuesday, 10 March 2020

It is, to me, ironic that the world has elected to celebrate this anniversary with – you guessed it – another epic global panic attack.

At this morning’s opening level of 2,764, the S&P 500 is down over 18% from its all-time high, recorded on February 19. Declines of that magnitude are fairly common occurrences – indeed the average annual drawdown from a peak to a trough since 1980 is close to 14%.* But such a decline in barely a month is noteworthy, not for its depth but for its suddenness.

As we all know by now, the precipitants of this decline appears to have been (a) the outbreak of a new strain of virus, the extent of which can’t be predicted, (b) the economic impact of that outbreak, which is equally unknown, and (c) most recently, the onset of a price war in oil. (That last one is surely a problem for everyone involved in the production of oil, but it’s a boon to those of us who consume it.)

Monday, 24 February 2020

After surveying nearly six thousand American workers, in July 2019 the Transamerica Center for Retirement Studies (TCRS)[1] published a report - Self-Employed: Defying and Redefining Retirement (Select Findings from the 19th Annual Transamerica Retirement Survey of American Workers.)[2] I have many clients that are self-employed who have a different view of retirement compared to the traditional retirement strategy - stop work at 65. The TCRS report describes the self-employed view of retirement as follows:

“Self-employment brings both unique opportunities and challenges for saving, planning, and preparing for retirement. The self-employed often lack a steady paycheck with a regular stream of income. Without retirement benefits offered by an employer, the self-employed typically must take a do-it-yourself approach to retirement savings. At the same time, self-employment also brings greater freedom, the freedom to work -- and retire -- on one’s own terms. “[3]

In this article, I highlight three key topics of the report - What is retirement? Some of the key findings of the report, and the report’s 10 recommendations for the self-employed to help them navigate and take advantage of opportunities available to them.

Monday, 17 February 2020

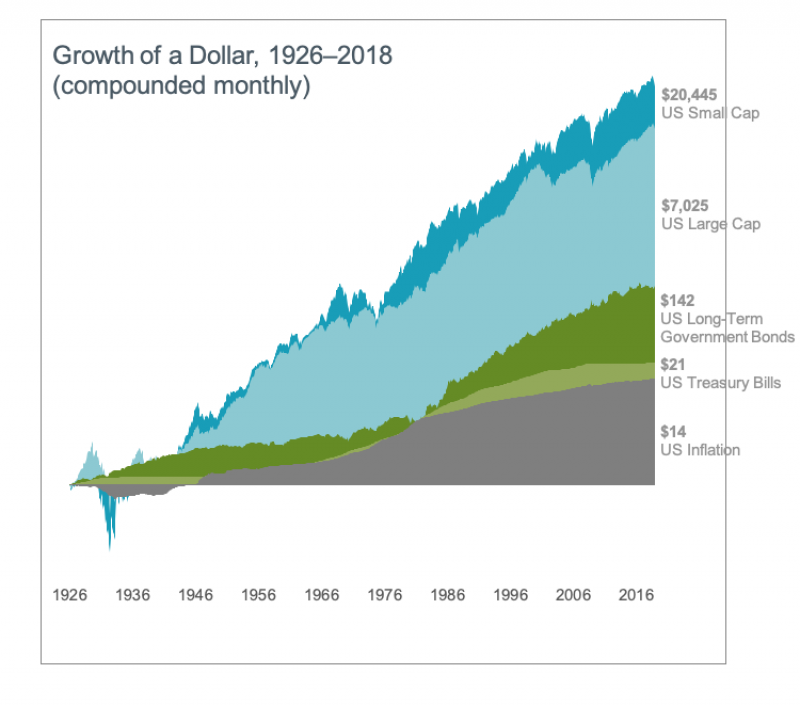

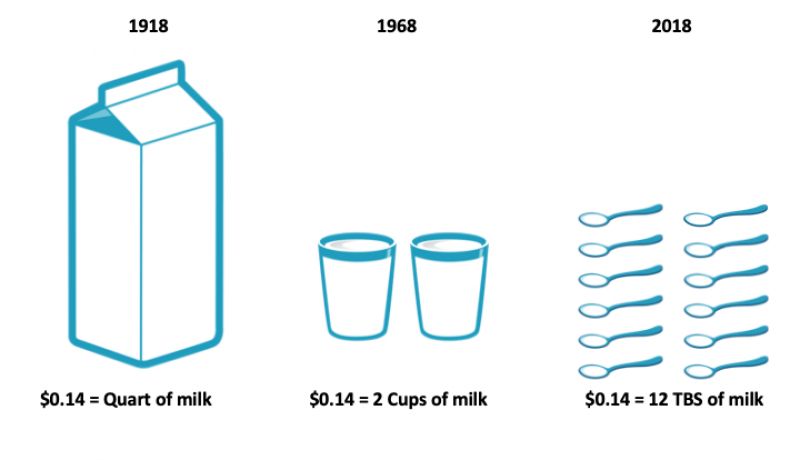

Saving is simply setting money aside in a safe place for a later date when you will need it, sometime in the distant future. Before we invest, we usually need to save money first. Investing is a means to building wealth over the long term--not a one or two-year period, but five, ten years or longer. If you want to build real wealth (returns significantly greater than inflation) in the short-term, or very short-term, your “investing” is high risk and more akin to making a bet. Even though one can make very educated bets, investing is best when it is done with the long view in mind. In order to save or invest, you need some patience; not so with betting.

Monday, 03 February 2020

People often come to me with concerns about investing in the financial markets, such as, “How can I invest and not be stressed out?” “How can I trust that I won’t be ripped off?” “All these investment jargons make everything so confusing,” and “I don’t want to risk losing everything.” Maybe you grapple with the same investment questions. So why do people invest? Is it really a good idea? In the next few articles, I want to help you understand how to invest your hard-earned money with confidence and have it work for you, even when the investment road gets bumpy (because it will).

Friday, 24 January 2020

This report provides a good overview of the risks being faced by women as they plan and approach retirement. We will all be taking the retirement route someday, remember, it’s never too late to make a plan for your retirement. At Boerum Hill Financial Advisors we want you to be able to retire with the confidence that you will have enough income to maintain your dignity and independence in retirement.

Thursday, 02 January 2020

Ah, January 1st -- a time when gym memberships skyrocket, people start a new diet or a cleanse, and we can even “cleanse” our budget with the help of books such as “The 21-Day Budget Cleanse[1]” (full disclosure: I’ve not read this book). A new year brings new hope, and this time it’s more than just a new year--it’s a new decade, the 2020’s! However, even in the midst of the anticipation and excitement, some of you may be overwhelmed with challenges such as getting rid of credit card debts and the feeling that you should do something different about your finances in the new year. While I do not have a “2020 quick fix” for finances, a good way to start is taking a look back on 2019.

Thursday, 26 December 2019

Getting to retirement is a long, eventful and exciting road, and it may progress like this for some people:

WIDOWHOOD

RETIREMENT

GRANDPARENTHOOD

REMARRIAGE

DIVORCE

EMPTY NESTING

CAREGIVER

CHILDREN

MARRIAGE

SINGLEHOOD

CAREER

The environment for retirees and those approaching retirement is changing significantly. Life expectancy is up 30 years since the last century. The U.S. 65-year-old population, currently 53 million, is expected to grow by 50% to 79 million in 2050[1], and the 85+-year-old’s is the fastest-growing demographic in the country. The average number of years we spend in retirement in the 1960s was about five, in 2010 it had grown to 30. All this has led to some retirement financial fears for people, such as - the rising cost of healthcare, the chance of outliving your money, will all my social security benefits be there? Along with this, will there be another market crisis, and how much will inflation eat into savings.

These are real retirement concerns people face for themselves and others.

Friday, 06 December 2019

I thought it would be valuable to you if I listed some strategies to keep your finances safer during the holidays and into 2020. With the help of the Bank of America, I have listed some areas for you to be aware of – forewarned is forearmed!

Also, if you are responsible for someone, such as an elderly relative or friend, I suggest you warn them about scams, giving them a copy of this blog may not be the best idea, I suggest you tell them about some scam scenarios that you think are relevant to them and to contact you before you do anything. As a general rule a scammer will want someone to act immediately, so “do nothing” can be a good strategy. AARP has a free helpline if you think you or loved one has been scammed – 877-908-3360.

Wednesday, 30 October 2019

Small business is vital to the U.S. economy, it employs half of the private-sector workers and creates two-thirds of net new jobs, according to federal data. As of 2018, there are 30.2 million small businesses in the U.S (99.9% of United States businesses):

The biggest challenges of running a small business, according to small business owners - Economic uncertainty, the cost of health insurance benefits, and a decline in customer spending, with regulatory burdens almost tying for that third-place spot.

Wednesday, 30 October 2019

Federal state and local taxes are up there with your biggest bills, about one-third of all you earn in your lifetime is going to be paid in taxes, so it makes sense to plan ahead and make sure your tax bill is as low as possible. Being a business owner or self-employed provides greater opportunity for tax-planning when compared to the salary and wage earner. Your goal is to minimize your tax bill (cash outflow) or defer your tax bill to a future period. Yes, tax planning can seem complicated, it involves planning for your retirement, tax installment payments, keeping up-to-date and accurate records and managing a key component of your cash flow. Tax planning also comes with the temptation to underreport earnings, what I refer to as “crossing the line”, but there is no need to put skeletons in your closet, you’ll sleep better, and your life will be less complicated. A former boss and President of a public company gave me some very sage advice early in my career:

“If you can see the line you are too close.”

Wednesday, 30 October 2019

How do you encourage yourself to do something that you swear today you’re going to do? Easy: Send yourself an email today for delivery to you in the future.

Think about how amazing it would be to get a surprise from the past. From yourself. “Send your future self some words of inspiration or comfort. Or maybe a swift kick in the pants” reads the introduction on futureme.org, where you write and store emails to yourself for eventual, scheduled delivery.

Wednesday, 16 October 2019

Your life of a performing artist is far from routine, it is not the typical 9 to 5 workweek, there are no employee benefits, annual leave, or a need to climb the corporate ladder, however, you are working in an extremely competitive industry, and especially in New York City. Accordingly, your life needs to be on-the-ready, searching for that next performance opportunity, the next audition, and doing your best to create your own luck. To operate like this you do what is needed to pay your bills, you are a freelancer, waiting for your 1099, that always seems to arrive late, living and loving the “gig-life”.

ADV | DISCLOSURES | PRIVACY POLICY

Copyright © 2018 Boerum Hill Financial Advisors, LLC | Powered by AdvisorFlex