A New Year ...“Sow What”?

Ah, January 1st -- a time when gym memberships skyrocket, people start a new diet or a cleanse, and we can even “cleanse” our budget with the help of books such as “The 21-Day Budget Cleanse[1]” (full disclosure: I’ve not read this book). A new year brings new hope, and this time it’s more than just a new year--it’s a new decade, the 2020’s! However, even in the midst of the anticipation and excitement, some of you may be overwhelmed with challenges such as getting rid of credit card debts and the feeling that you should do something different about your finances in the new year. While I do not have a “2020 quick fix” for finances, a good way to start is taking a look back on 2019.

Work, Tasks, and Musing

You probably have just enjoyed a festive holiday break with friends and family, survived the relatives, overindulged a little, and overall managed to slow down a bit and detach from the day-to-day. The holiday break can be like the time after a big snowstorm--the usual sounds have been covered by tranquility, and the pace of life yielded to the fresh coat of snow. Now is a good opportunity to muse about the year just past and ponder the new year ahead. I suggest you put your feet up, enjoy a hot drink, take up a pad of paper and just start writing about 2019. Think of the year under the following categories: health, finances, vocation, and relationships. What happened in 2019? What did you want to happen but did not? I am often surprised by the things that happened which I had some control over, but do not recall making a conscious decision about.

Sow What?

When I was a young boy living in Australia, there was a Sunday TV show called “Sow What”. It was a brief 15-minute gardening show that gave seasonal gardening tips and ideas. Even though my gardening days are behind me now that I live in NYC, I find myself thinking about the title of the show and how it applies to my finances. If you have done your 2019 musings, you can now give some thought to the seeds you want to sow in 2020. In my time working in large global organizations I learned quickly that if I was going to achieve anything with my team, I needed to sow the seed of change a good year in advance. Planned changes happen slowly in large organizations because everyone is seeking limited resources and competing to be a priority. The same may apply to personal finances. But before we plant our seeds for 2020, we need to first prepare the soil.

In order to perform well, one needs to have several things in place. This is called having a good set-up. A good set-up is the soil for a change in your finances (better cash-flow management, a budget, increasing savings, living within means, investing for retirement, buying property, and so on). I once had a client who wanted to improve their finances with over a dozen credit cards and several bank accounts at various institutions. In this example, the soil was covered by weeds of complexity and needed to be dealt with accordingly.

So, what is a good basic set-up for your personal finances, so that the seeds you sow for 2020 have a chance to grow and perform for you?

A good financial set-up

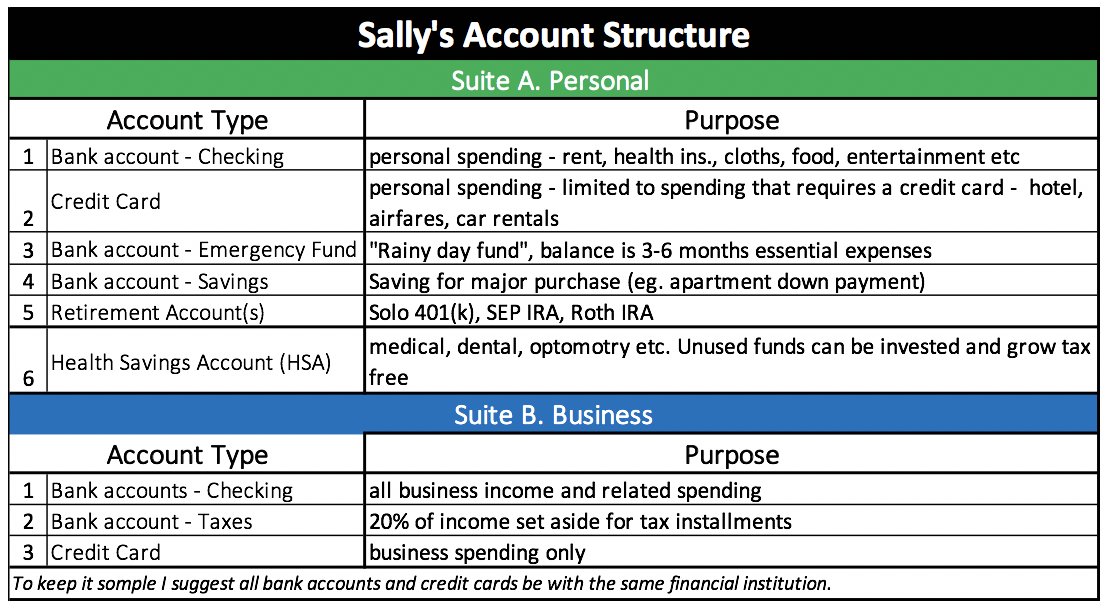

Here is an example to illustrate a good financial Set-up. Sally is a performing artist who works various jobs (teaching, waiting tables, voice-over work) to pay the rent and other expenses, as well as her lessons and studio time. Her main focus is on her next audition and performance. Sally’s ideal financial set-up needs to be simple, easy to understand and plan so that she can keep her focus on performing. The key to a good financial set- up is your account structure (Business 101: “structure before process”). Below is my recommended account structure for Sally, the types of accounts she should maintain and their purpose.

The benefits of this set-up for Sally is that it keeps her personal and business finances separate, each account has a clear purpose and use, and will encourage good financial habits. Also, this set-up will allow Sally to quickly understand her financial position at any time simply by knowing the balance of each account and the cash in her wallet. Having an accurate picture of her financial situation informs Sally of any action she needs to take.

It is important to note that Sally limits the use of her credit cards to business expenses and things that require credit cards, such as hotel, airfare and car rental. For other personal expenses, she uses cash as often as she can. Why? This will help her budget, control her spending and encourage living within her means.

Take a look at your current account structure. Chances are, your account structure is not by design, but rather evolved over time. If you are self-employed, I recommend adopting the account structure in Suite A. and Suite B. If you are an employee, I recommend Suite A. as a good set-up for you.

Sowing for 2020

Having a good set up will help you keep track of where your money goes and reaching the goals you want for 2020, such as building good spending habits, reducing debt, increasing savings, or purchasing a property. As for me, I am entering 2020 with a good set-up and would like to improve my spending habits and save some more. In my case, I’m going to sow the seed of minimizing personal credit card use and maximizing cash use. What will you be sowing this year?

“Set yourself up for success and anything is possible” - SPARKPEOPLE

[1] The 21-Day Budget Cleanse: Three Weeks to a Leaner Budget & a Fatter Wallet

by Ted Jenkin, Greg Abel