Investment Topics #2: Investing, It's A Journey

Saving, Investing, Betting

Saving, Investing, Betting

Saving is simply setting money aside in a safe place for a later date when you will need it, sometime in the distant future. Before we invest, we usually need to save money first. Investing is a means to building wealth over the long term--not a one or two-year period, but five, ten years or longer. If you want to build real wealth (returns significantly greater than inflation) in the short-term, or very short-term, your “investing” is high risk and more akin to making a bet. Even though one can make very educated bets, investing is best when it is done with the long view in mind. In order to save or invest, you need some patience; not so with betting.

The Investment Journey

Investing will always come with risk and reward, the two sides of the same coin. It requires discipline and patience over time—sometimes a long period of time. Investing is like going on a journey. There are many different investment journeys to choose from, ranging from a gentle walk in the park, to a bumpy, hair raising roller-coaster ride, and everything in-between; the choice is yours. If you choose the gentle walk in the park, it is going to be uneventful, which means that your investment will grow very slowly but surely. The rollercoaster ride, on the other hand, will be bumpy, and you will likely begin to panic when you read headlines such as “The Death of Equities!” Therefore, it is extremely important to select a journey you will stay with, and not want to get off and switch to a totally different one when it becomes too bumpy or if too gentle and you develop FOMO (fear of missing out).

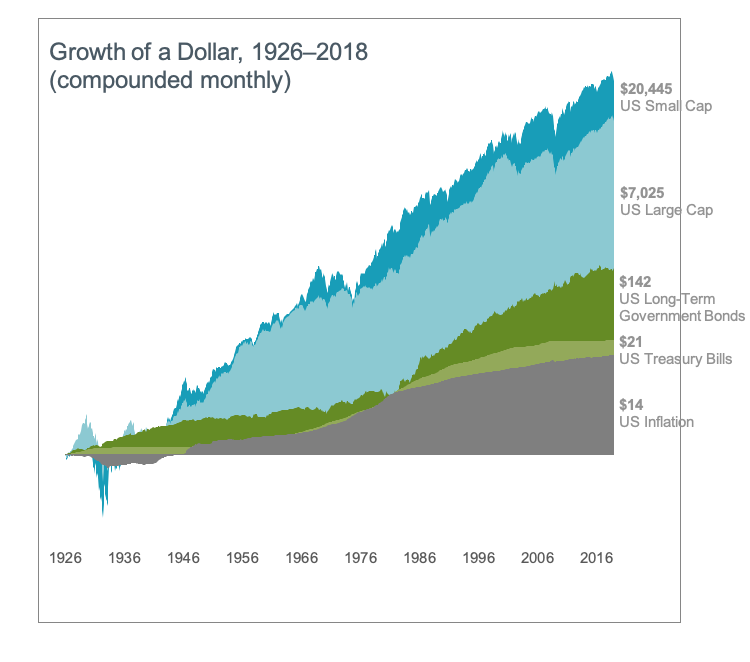

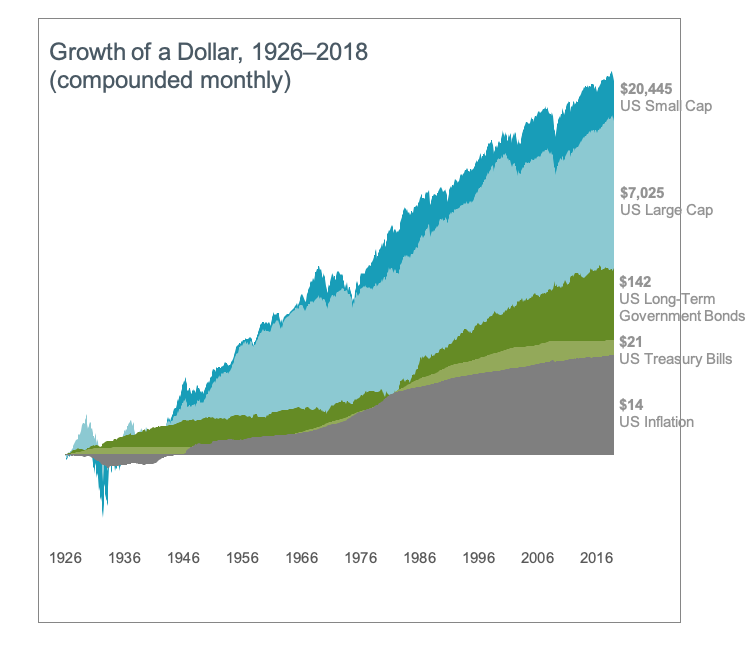

The graph below, “Growth of a Dollar, 1926 to 2018”, highlights how the financial markets have rewarded long-term investors from 1926 to 2016. People expect a positive return on their investment, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation. The figure shows that if you chose the roller-coaster ride and invested in a US Small Cap Index fund, your one-dollar investment in 1926 grew into $20,445 (10.8% CAGR) over the 90-year period. Similarly, the US Large Cap Index grew $7,025 (9.7% CAGR) and Govt. Bonds Long-Term grew $142 (5.4% CAGR). However, if you took a gentle walk in the park with an umbrella and invested in Treasury Bills, your one dollar increased to just $21 (3.3% CAGR) in the same time period. There are many risk-reward choices when investing for the long term in selecting an investment journey. An investment portfolio ideally reflects your risk and reward expectations considering your future needs, goals, and aspirations.

It requires discipline to select an investment portfolio and stay with it, avoiding the media headlines and becoming anxious, or feel enticed to chase the latest fad. Choose an investment portfolio--and therefore an investment journey--that will keep you on course. The choice of the journey is different for every investor. Work closely with a financial advisor who can offer expertise and guidance to help you focus on actions that add value.

At Boerum Hill Financial Advisors, our clients understand that they need investment help, and are looking for guidance and want to learn. When developing investment strategies for clients we focus on what you can control and believe it will lead to a better investment experience. Together, we will:

- Create an investment plan to fit your needs and risk tolerance

- Structure a portfolio along the dimensions of expected returns

- Diversify globally

- Manage expenses, turnover, and taxes

- Stay disciplined through market dips and swings

For more information, or if you have questions, please contact me at This email address is being protected from spambots. You need JavaScript enabled to view it.