Single Parents - What Does Your Financial Set-Up Point To?

As a single parent, you have been doing the right things: budgeting your spending, paying down debt, saving for retirement, all the while paying for the kids’ braces, and saving for their college. You juggle home and work, learn from mistakes and know what works best for you. Perhaps you are now wondering: As my financial goals get clearer, how realistic are they? How do I reach them?

Having the right setup is critical to increasing the chance of hitting any target, from everyday tasks like baking a cake to big goals like your finances. Your Financial setup is made up of many components, including income, savings, investments, insurance, new job, etc. It plays a key role in determining if you get to where you want to be financially.

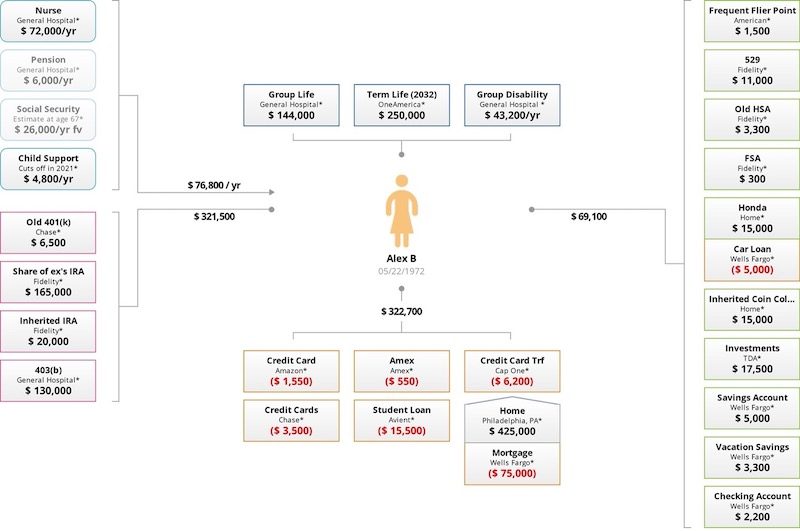

The components of your financial setup accumulate over time, which often happens without you noticing. When you first started working you probably had a checking account, credit card, and student loans. You may also have had a savings account and an employer-sponsored 401(k) retirement account. Each month, your salary was deposited into your checking account, from which you paid your bills. Now, twenty or thirty years later, with several jobs listed on your resume and perhaps having gone through a few highs and lows in life, your financial setup has grown. In addition to checking and savings accounts, your financial setup now includes health savings accounts, insurance policies, social security, several credit cards, a mortgage, car loan, current an old 401(k)’s, and 403(b)’s. You may have even inherited an IRA and a coin collection from an uncle, and have a lot more bills to pay each month. Your financial setup now could look something like Alex’s:

ALEX’S FINANCIAL SETUP

Alex is a 49-year-old single mother. Her financial setup, neatly presented above, comprises of more than twenty accounts! It includes four current and future sources of income, four retirement accounts, four credit cards, student debt and a mortgage, three insurance policies, seven saving and investment accounts, a car and car loan, and a coin collection. This is not an unusual case. The question is: Is this the best setup for Alex and will it get her to where she wants to be?[1]

Every component of your financial setup should point to your financial goals.

Your goals may include things like a certain desired lifestyle for the future (an RV, anyone?), early retirement, security for a rainy day (healthcare is a big one), vacation home, absence of debt, having your own business, and even the legacy you wish to leave for others. Aligning your financial setup to your goals gives you the best chance of reaching them.

Single parents have a lot on their plates–work-life challenges, restarting a career, managing children’s schooling, and sometimes conflict between parents –to name just a few. It may sound obvious, but you can develop a secure financial future by being proactive about your financial setup. Now is a great time to take stock of what you have and see if it will get you to where you want to be and when. As a financial and investment advisor, one of my first tasks with a new client is to create a clear picture of their current financial setup and gain a sense of where they want to get to. This would help me to answer a question I often get: “Am I on the right path to where I want to be financially?”

What you can do today.

Evaluating your financial setup is not difficult. 90% of the information is likely in your head already if you have a good idea of what you have and what you are doing with your money today. You are on an important journey, so it’s worthwhile to find out if and when you will get where you want to go. Here are some steps you can take:

- Create a picture of your financial setup by listing all the components: Income sources, assets, liabilities, and insurance. You can use Alex’s financial setup as a sample checklist.

- For a good understanding of where you want to get to and in what timeframe, think of the best, okay, and worst future scenarios.

- Ask yourself the question: “Am I on the right path to where I want to be financially?”

- If you are unsure of your answer, seek advice from a fiduciary fee-only financial advisor. Why fiduciary fee-only financial advisors? Because they are on your side and have some skin in the game.

You can visit my website www.boerumhillfa.com and schedule a no-obligation one-hour strategic session with me, where you can confidentially share your financial concerns and learn how I can help you get to where you want to be. Alternatively, you can contact the National Association of Personal Financial Advisors[2] to find a financial advisor near you.

[1] Alex’s goals (in today’s dollars) – Retirement income of $60,000 a year, from age 70 to 95; Travel budget of $7,500 a year, from age 70 to 75; added medical expenses of $7,000 a year age from 75 to95.

[2] www.napfa.org