Small Businesses and the Impact of Covid-19

Over 30 million jobs are vulnerable - and the number might be higher

The Small Business Administration defines a small business as a company with less than 500 employees, which means there are a lot of small businesses in the U.S. In fact, it’s likely that given COVID-19, there are more companies that were just recently considered mid-size or maybe even large companies that now fall into the small business category. But unfortunately, the pandemic has wreaked havoc on the small business community – and we might not know the full impact for years to come.

Small Businesses Are Critical

There are almost 31 million small businesses in the

U.S. that account for 99.9% of all U.S. businesses. That’s essentially a business for every 12 people in the U.S. (SBA, 2019). But consider these additional statistics:

- Businesses with fewer than 100 employees account for 98.2% of all U.S. businesses

- Businesses with fewer than 20 employees account for 89% of U.S. businesses

- Small businesses employ 58.9 million people, which makes up 47.5% of the country’s total employee workforce

- The industry of “Other Services, Except Public Administration” has the largest number of small businesses with 4.4 million firms

- After “Other Services,” the next three industries are Professional, Scientific, and Technical Services (4.2 million); Construction (3.1 million); and Real Estate, Rental and Leasing (2.9 million)

With so many small businesses in the U.S., it’s no surprise that small businesses generate the majority of jobs in the United States. And while precise numbers are often difficult to track, it’s estimated that small businesses create about 1.5 million jobs every year and account for close to 64% of new jobs created in the U.S. (Fundera, 2020). Of course, those statistics were documented prior to COVID-19, so it will be intriguing to see if they hold up post-pandemic.

Irrespective of the precise percentage of new jobs that are attributed to small companies, the truth is that small businesses have always played a substantial role in our economy, contributed a huge amount to our GDP, and created new and exciting products and services as they become larger businesses. Just consider that 25 years ago, Amazon had 11 employees.

As We Age, We Start Businesses

While one might expect (or hope) that younger generations might be more inclined to start small businesses, the Kauffman Index surprisingly shows that those in their mid-40s and early 50s do so more often.

Here’s the age breakdown of small business- ownership:

- 20-34: 15.79%

- 35-44: 24.93%

- 45-54: 30.81%

- 55-64: 28.47%

While these age brackets don’t perfectly coincide with generational labels, older Generation-Xers and Baby Boomers are more likely to start a small business compared to younger Generation-Xers and Millennials. (Kauffman, 2019)

Impact of COVID-19

Small businesses face an array of challenges, including lumpy cash flow, soft product demand, and difficulty in finding talent. And while historically these have been among the top challenges faced by small business owners, there is no doubt that COVID-19 will soon top any list of challenges – and we might not know the true impact for years.

But a picture is starting to emerge, and it’s not especially pretty. In fact, one might describe it as bleak.

Consider these very recent stats:

- By mid-April; according to a report from the Facebook & Small Business Roundtable, approximately 1/3 of small businesses had stopped operating

- By the middle of May, more than ½ had laid off or furloughed employees

- Before the year is over, 25-36% could close permanently (McKinsey, June 2020)

The reasons small businesses might close might have COVID-19 as a common denominator, but the pandemic might have exposed weaknesses in certain businesses too. For some, the impact is due to changing customer behavior, especially as it relates to social distancing, mask-wearing, and other operational changes mandated by local governments.

But the real challenge might simply be that many small businesses were at risk prior to the pandemic and simply could not survive an interruption or change to their business for even a month, let alone longer.

To underscore this last point, research from the Federal Reserve found that only about 1/3 of small businesses were healthy at the end of 2019. Further, the Fed’s research suggested that the other 2/3 were “three times more likely than the others to close or sell in response to a revenue shock.” (Federal Reserve, 2020). And if nothing else, COVID-19 has been a revenue shock.

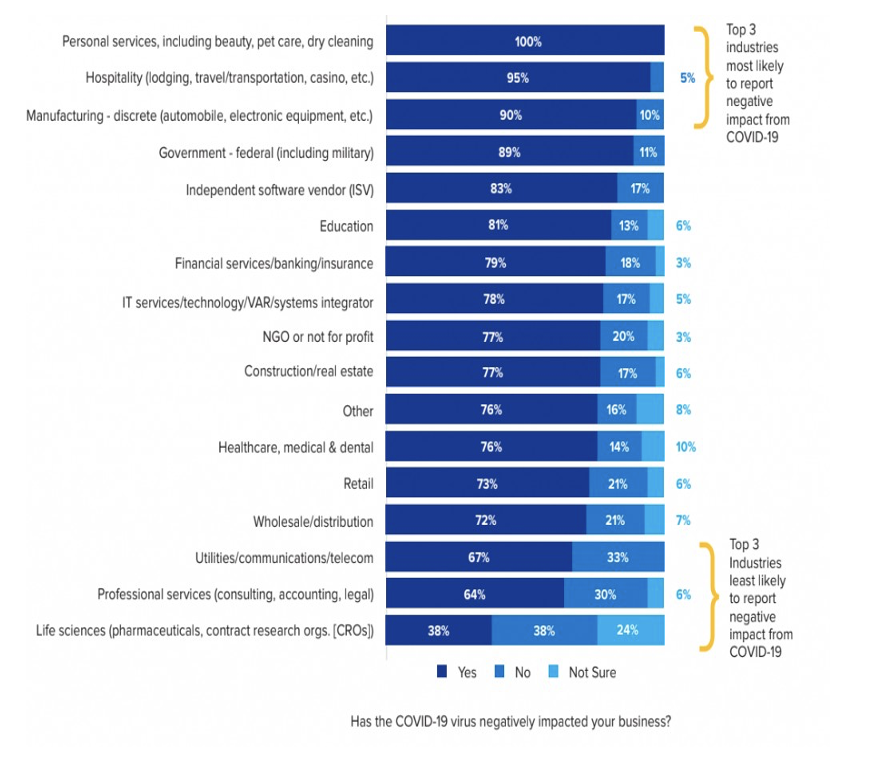

To further underscore this point, consider the results from a survey by the SMB Group of more than 500 businesses designed to find out which small businesses might be most impacted by COVID-19 (SMB, 2020). The consensus was that the smaller the company, the worse off they would be. In fact, those surveyed specifically mentioned that companies with less than 20 employees might be hit the worst. The reason? Companies with so few employees generally lack sufficient cash flow and have less cash reserves.

Here are the top types of small businesses most likely to be impacted by the pandemic, according to the survey:

What it Means Going Forward

If we start from the point that small businesses account for so many private-sector jobs, then it stands to reason that small businesses will lead the way back in recovery. The challenge, however, is that with so many small businesses closing due to the pandemic, the impact on longer-term employment is likely to be more severe as these businesses are just no longer around to hire employees back.

Consider these estimates from McKinsey:

- 50% of jobs at firms with fewer than 100 employees are vulnerable to being lost, compared to 40% of those at larger private- sector employers (McKinsey, May 2020)

That is why there is such a strong push to keep local businesses afloat. Not only so we can protect small businesses in the short-term, but also so that our recovery can take hold and new entrepreneurs will continue the trend of starting businesses, hiring employees, and putting our economy on solid ground for years to come.

Sources: Fundera, McKinsey, SBA, Federal Reserve, SMB, Kauffman

Copyright © 2020 Financial Media Exchange, All rights reserved Distributed by eMoney Advisor, LLC